Energy Secretary Jennifer Granholm delivers a prerecorded message during a briefing on clean energy tax incentives available to faith-based communities in a July 18 webinar organized by Interfaith Power & Light. (NCR screenshot)

A provision in last year's historic climate law that permits tax-exempt entities to qualify for clean energy tax credits is a "game changer" for faith communities, positioning them to save on utility bills and also to become leaders in the nation's response to climate change, said Energy Secretary Jennifer Granholm.

Direct pay, or elective pay, was included in the Inflation Reduction Act that President Joe Biden in August 2022 signed into law, investing an unprecedented $300-plus billion in climate-related programs and tax incentives. The provision allows organizations that do not pay taxes to receive a direct payment from the IRS equal to the eligible tax credit discount.

In the past, such organizations, like houses of worship, did not qualify for tax credits tied to clean energy projects, such as installing solar panels or electric vehicle charging stations. With the majority of dollars for clean energy under the Inflation Reduction Act coming in the form of tax credits, direct pay allows faith-based organizations and other nonprofit and government entities to take advantage of those incentives — including a minimum 30% credit for eligible clean energy investments, such as solar arrays, with additional credits available for projects in low-income communities or that use domestic materials.

In a prerecorded message during a July 18 briefing for congregations hosted by Interfaith Power & Light, Granholm called direct pay "a real game changer" for houses of worship to lower the costs of projects that produce or store clean energy.

"Through President Biden's Investing in America agenda, we created this unprecedented suite of tools to help congregations reduce their carbon footprints, their carbon pollution, while also being climate leaders in their communities," the energy secretary said.

Granholm noted there are many examples of houses of worship already taking leading roles in response to climate change, from a Baptist church in Oakland serving as a resilience hub during wildfires and extreme weather, to countless churches, synagogues, mosques and other prayer sites across the country that have installed solar panels.

"It's clear to me, as I know that it is to all of you, that faith organizations are uniquely positioned to get the word out about the stakes of this moment, and the tools that we have at our disposal to meet it," she said.

The webinar, which was co-sponsored by Catholic Climate Covenant, Creation Justice Ministries and other faith organizations, took place during a summer of record-breaking heat for large parts of the U.S. and as major storms and flash floods have devastated the Northeast and South. Climate scientists have stated that as global temperatures rise — primarily due to the buildup of greenhouse gases in the atmosphere emitted from burning fossil fuels — heat waves and droughts are expected to persist longer and storms and flooding will become more severe.

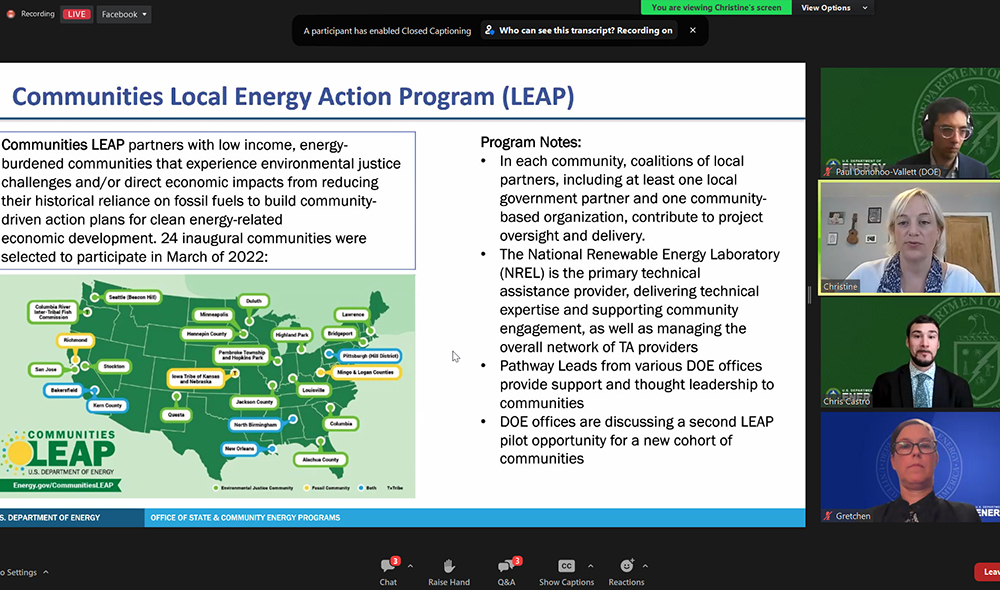

Staff from the Department of Energy's Office of State and Community Energy Programs outline a variety of clean energy tax incentives and grant programs created through the Inflation Reduction Act during a July 18 webinar for religious-based organizations. (NCR screenshot)

The Inflation Reduction Act's climate policies are considered a cornerstone of the U.S. commitment under the Paris Agreement to lower national emissions between 50% and 52% below 2005 levels by 2030, toward the global goal of limiting planetary warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit).

The hour-long webinar featured officials from the Department of Energy, including staff from the newly created Office of State and Community Energy Programs. They highlighted the slate of programs and incentives available to congregations under the Inflation Reduction Act, or IRA, as well as the infrastructure law and the CHIPS And Science Act, which together have invested more than $500 billion in the U.S.'s clean energy transition.

"These bills provide people of faith and conscience with more opportunities to live our values of caring for one another and for our sacred earth," said the Rev. Susan Hendershot, president of Interfaith Power & Light.

Roughly $100 billion has been allocated to the Department of Energy for grants and rebates, with programs aimed at encouraging Americans, businesses and organizations to adopt electric vehicles, solar power, energy storage, heat pumps and other energy-efficient upgrades. Many of the incentives place emphasis on environmental justice by providing additional funding to deploy clean energy and reduce pollution in low-income areas, historically disadvantaged communities and "energy communities," or areas around coal mines, oil and gas wells and power plants.

"It really pulls clean technologies from the fringes into the marketplace," said Chris Castro, chief of staff of the State and Community Energy Programs office.

In mid-June, the Treasury Department issued rules for direct pay, which is accessible beginning with projects that go online in 2023. Along with faith-based communities, state and local governments, Native American tribes, rural energy cooperatives and 501(c)(3) and 501(a) organizations are also eligible.

Direct pay can be used with 12 of the IRA's tax credits, among them: energy generation from solar, wind and battery storage projects; building community solar; installing electric vehicle charging infrastructure; and purchasing electric vehicles. Once a project is completed, tax-exempt organizations that register with the IRS receive a payment equal to the credit savings after a tax return is processed. The tax credits can be combined with government-issued grants and loans.

Hendershot told EarthBeat that Interfaith Power & Light has long advocated for a means for nonprofits to access funding for clean energy projects — which for solar can reach several hundred thousand dollars — including bipartisan legislation for grants that also drew support from U.S. Catholic bishops. She said the availability of direct pay has renewed enthusiasm and interest in clean energy projects among faith groups.

Advertisement

Before, a congregation interested in installing a solar array would have "to get incredibly creative with their financing," Hendershot said, whether fundraising for it, finding a major donor, or even identifying another business or entity or establishing an LLC that would be eligible for a tax credit.

Since its formation in 2017, Catholic Energies, a program of Catholic Climate Covenant, often facilitated power purchase agreements for parishes and schools wanting to install solar or other energy projects. In a power purchase agreement, an outside investor able to take advantage of federal investment tax credits pays the installation costs and owns the solar project. For the Catholic organizations, that left them with little to no costs while saving thousands on utility bills.

But power purchase agreements are not available in every state or region, said Page Gravely, executive vice president for client services with Catholic Energies. With direct pay, the organization owns the project and in doing so can optimize the financial and environmental benefits, he said.

Roughly 30% of the solar projects that Catholic Energies has under development or construction are utilizing direct pay. That includes a 3-megawatt array at the National Shrine of St. Elizabeth Ann Seton, in Emmitsburg, Maryland, and a 1.5-megawatt array at the Daughters of Charity' motherhouse in Indiana. SSM Health is also using direct pay for a solar project at one of its hospital properties.

Even with direct pay now an option, for many the challenge of raising the capital upfront for a major energy project remains.

To help lower costs, the IRA tax credits offer 10% bonus reductions each on top of the 30% credit for projects located in low-income areas or energy communities, and for those that use primarily domestic components and materials. A mapping tool created by the Environmental Protection Agency identifies communities designated as low-income.

The presence of the credits can help with securing a loan and assist development offices in raising capital, Gravely said. Knowing that at least 30% of a project's cost will be repaid within a year of installation offers a donor, be it a diocese or outside organization, greater assurance that the loan will be repaid, he said.

"They know it's a pretty good surety of repayment on the loan," Gravely said, though he added there are cases where a power purchase agreement may still be the better option.

Hendershot suggested that congregations can also look for faith-based loan programs, which often offer low interest rates, or see if funding is available through green banks or community-based foundations.

"It's not a perfect answer ... but it's much more than existed before, and it might just get some of those projects over the finish line," she said.

Funding is also available for faith-based organizations through a series of grant programs overseen by the Department of Energy for state, local and tribal governments, which provide funding to scale up clean energy and energy efficiency and to reduce greenhouse gas emissions, with special emphasis on rural and disadvantaged communities as part of the Justice40 Initiative.

Along with direct pay, the webinar highlighted other programs to help houses of worship offset the costs of energy upgrades.

The Renew America program, launched in May, offers funds to nonprofits for energy efficiency improvements. It will award $45 million in grants to 5-15 organizations who apply to serve as program leads that redistribute the funds to various projects, with a maximum $200,000 per project. Interfaith Power & Light said it plans to apply, with the goal to reallocate money to congregations and faith-based schools and organizations. The deadline to apply is Aug. 3.

In addition, the Energy Department has made millions of dollars available through several prizes for energy innovation, community coalitions and energy upgrades in existing buildings. Granholm added that faith communities can be important messengers in informing their congregants about other tax incentives and programs to make improvements in their own homes and businesses as well as programs and funding for clean energy jobs training.

Hendershot told EarthBeat that the current moment is a marked shift for environmentally focused groups after decades of advocating for impactful climate legislation from Congress. Now that legislation is law, their focus is on implementing and ensuring the communities that were historically overlooked or left behind are at the forefront in the country's clean energy transition.

"We're in just a different position, where we can see this really incredible future that we can have if we do this right," she said. "You know, if we take full advantage of this opportunity and implement it right, it can just be transformative."